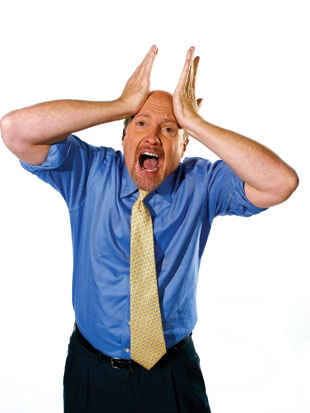

Cramer Versus Cramer Part 2 -- A Bear Raid

In my last post, I expressed a great deal of frustration with the lost opportunity Cramer and Stewart passed up to educate an engaged audience. Probably one of the more notable examples of this came when Jon Stewart presented Jim Cramer with video clips of himself from 2006. The Daily Show pointed out segments like:

Cramer: You know a lot of times when I was short at my hedge fund and I was positioned short, meaning I needed it down, I would create a level of activity beforehand that could drive the futures. It doesn't take much money.

Cramer: I would encourage anyone who is in the hedge fund unit 'do it' because it is legal. It is a very quick way to make the money and very satisfying. By the way, no one else in the world would ever admit that...

What was he talking about? You can tell Stewart's entire 'beef' of the interview lay in getting Cramer to justify such comments. Of coures, Cramer didn't. Neither really explained what he was talking about. It was just assumed it was understood.

I thought it would useful to do a quick breakdown of this dialogue. Stewart was trying to motivate Cramer to discuss a "bear raid." A strategy, although more common during the early 20th century, that involves taking large short positions (and/or colluding with others to take large short positions) and spreading unflattering rumours of the target firm with the set goal of dragging the share price down. The group profits between the original share price and the price that the share price has been dragged down to. This brings a "surer thing" to big-wig traders and hedge funds, while leaving the retail investor, saturated in the buy-and-hold philosophy, out to dry.

A recent example that comes to mind of rumours being spread in the market to get a share price down was when rumours were flying that a healthy Steve Jobs was terminally ill. Every time those rumours gained traction, it sent Apple shares down. There is a great deal of speculation attributing these unsubstantiated rumours to hedge funds. While, today, the poor Jobs has actually taken time off to deal with some sort of illness, traders and hedge funds managers, I believe, have been poking at his health for years.

An unusual thing was that Cramer in the 2006 video commented this behaviour was perfectly legal, which is not entirely true as it might represent securities fraud.

Next blog post we'll review Cramer's response, mentioning a little thing called the "uptick rule." Huh? Uptick rule?

Labels: bear raid, Jim Cramer, Jon Stewart, short selling, The Daily Show

0 Comments:

Post a Comment

<< Home