Do you remember watching an entire show at a particular time to wait for a particular segment? It really almost feels like something our great grandpappies did. Comedy aside...today, we can simply be alerted to snippets of information by our peers or by certain publications and the relevant piece can easily be found online. Such was the case this weekend when a brilliant pathologist friend of mine took me through clip by clip of the battle between

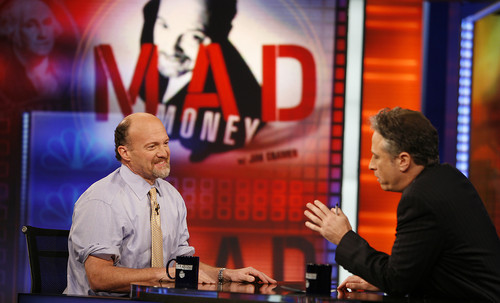

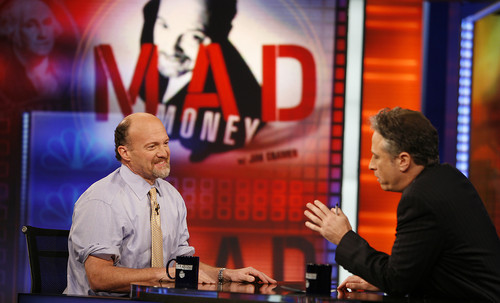

The Daily Show's Jon Stewart and

Mad Money's Jim Cramer. Now, this had been the news of the week all last week. Had this been a past era (and by "past era," I mean a few years ago), the favoured water cooler conversation of the moment would totally have been missed by myself.

It all began with the

Daily Show putting together a very effective onslaught of CNBC's coverage of the financial markets. The piece was a substitue to a cancelled guest appearance by CNBC's Rick Santelli, who was due to explain his opposition and subsequent reporting of homeowners being saved from foreclosure with government bailout funds. Part of the collage of attacks were clips of

Mad Money's Jim Cramer giving bad calls on Bear Stearns and Bank of America. Cramer, taking exception to the comments, went on a media blitz undermining Stewart, and we had ourselves one of the more compelling media personality rivalries this year.

Stewart's attack was legitimate and eloquent. It made a point stressed by investor advocates for years: the ineffective coverage of news organizations. Numerous clips were played illustrating the CNBC's staff lack of effective reporting and greater priority being placed on being the mouthpiece for the companies they were reporting on than any sort of investigative journalism. However, Stewart's observations was hardly old news. For example, it was Vanity Fair that first commented on the suspicious Enron, not the Wall Street Journal or Financial Times.

It was Cramer's appearance on the Daily Show after much bickering back and forth that I want to draw attention to. The two men were given a huge audience to discuss incredibly important issues, and Cramer simply chose to be Jon Stewart's punching bag, acknowledging everything coming out of Stewart's mouth while not taking an opportunity to amplify the issues. My personal resentment of the show,

Mad Money, has existed since the show came out. But, in all fairness, Cramer failed to point out his definition of

Mad Money, which was "...not retirement money, which you want in 401K or an IRA, a savings account, bonds or the most conservative of dividend-paying stocks." Furthermore, the challenge of having an avenue in which everyday you are putting a buy or sell recommendation on a stock to be evaluated by a broader public is a tough gig. Nobody else does it (not on such a grand scale anyway). Cramer's past hits and misses is noted at the end of each show, and his lack of success can easily be evaluated. Mutual fund managers do have to provide disclosure on their top holdings but not in real time, and hedge fund managers do not have to talk about it at all.

For all my criticisms of "Mad Money," Cramer should have pointed out that the show does succeed in giving people a way to educate themselves about the markets in an entertaining manner. For every verdict Cramer renders on a company, he does talk about his reasons and about the company themselves. It has made people more engaged, increasing their IQ of publicly-traded companies. Of course his theatrics and yelling, while aggravating myself, also did entertain his audience bringing an audience bored with the normal presentation of business reporting into the mix.

This all being said, my love for the Daily Show and Jon Stewart is quite strong, as watching these clips did provide a sense of satisfaction. Vital issues for investor (and this means all of us) rights were being presented to a mainstream audience. There seems to be a definite interest for business news to not spark widespread selling, and this does mislead the public. Stewart was right to define the participants in the markets into two groups: the retail investors saving for retirement and the cowboys (and girls) on the institutional side. Keep up the good work guys.

My next blog post is going to be about the behaviour of hedge funds in this whole mess. During the interview, Cramer, a former hedge fund manager, was questioned about the comments he made in an interview several years ago. Neither of the two gentlemen fully explained the issue. Stay tuned.

If you guys have not checked out the interview yet, follow this link:

http://watch.thecomedynetwork.ca/the-daily-show-with-jon-stewart/best-of/jim-cramer-interview-uncut/#clip149637

Labels: CNBC, Jim Cramer, Jon Stewart, Mad Money, Rick Santelli, The Daily Show